I first published this blog post back in June 2017. I’ve dusted it off and rewritten it today purely because of many conversations I’ve had over the last six months with people who have inherited large sums of money. Receiving money due to the death of someone you love is an awful way to come into money. So, if you are the recipient, make it count and make that person proud of the decisions you make with their money.

All tagged Emergency Fund

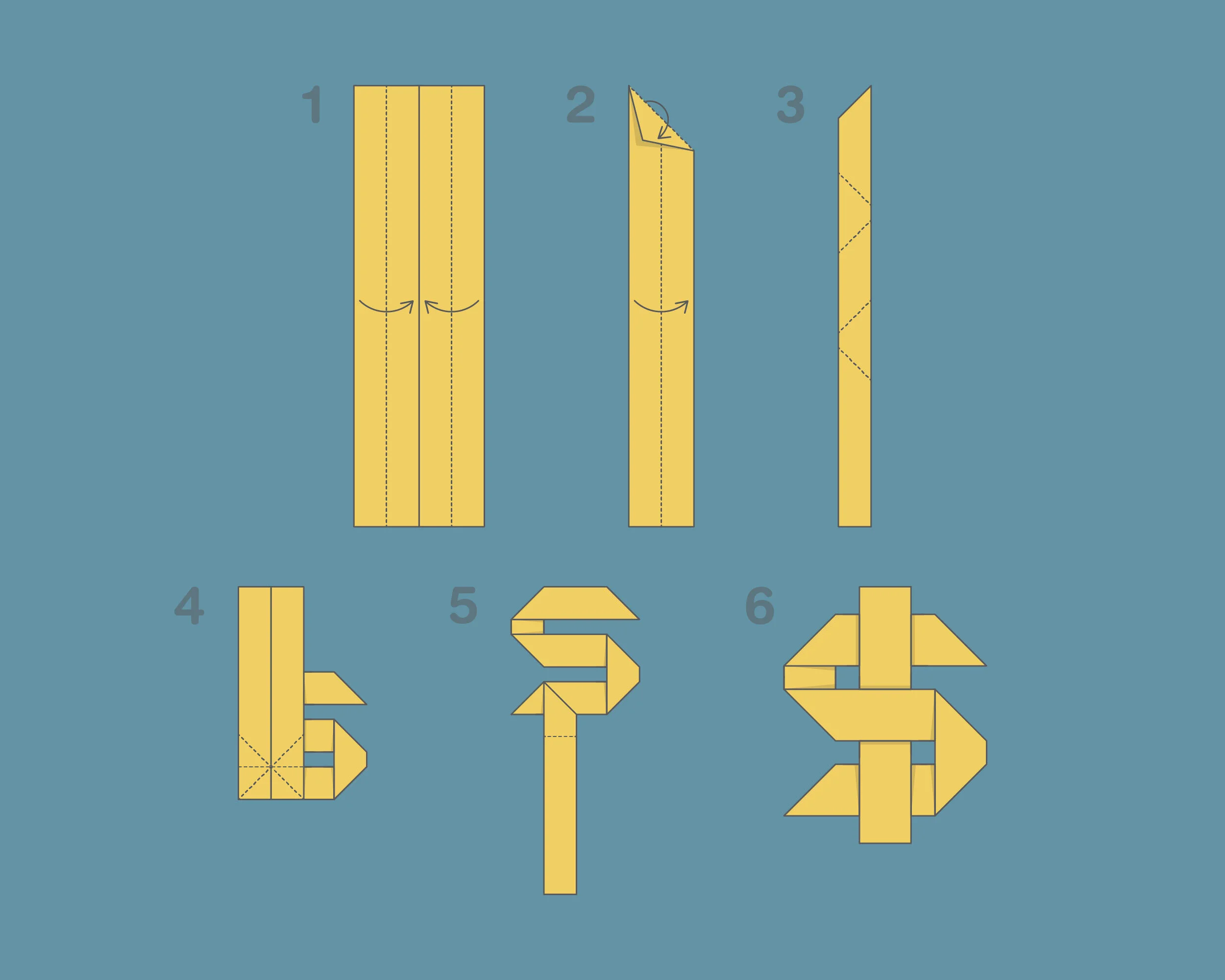

Begin at the Beginning: Step-by-step Path to Financial Independence

Whatever it is that you are embarking on that’s always the best place to start in my opinion. The beginning. Then just follow the path, in my case, the path to financial independence and eventually not being tied to a job to earn my income. It’s a long journey but it’s one worth starting. I’m often writing emails that cover the same points over and over again, so I thought that today I’d put that information into a blog post for all of the people wondering where to start and how to string all the bits of information you have learned about money into a cohesive order.

Financial Peace in an Emergency

This blog post might be the quickest and shortest one I have ever written! My inbox has just received yet another round of invoices for payment. February has been a particularly expensive month with a number of invoices due for payment over and above what we would usually expect. Some we have budgeted for and had fully covered, others we had partially saved for or were out of the blue. For the unexpected expenses, I was faced with only one option really, to reach into our emergency fund and use that to pay the invoices.

Consistency and Planning, boring yet effective.

I thought I would start the year with something that I think is a mega important topic if you want to get your finances in order, Consistency and Planning. Both are boring yet effective. As always, I like to share what I’m up to and what works for us, you can then take from it what you will. A few years back I implemented a few simple things and today I’m reaping the rewards of my consistency, planning and good habits. You can do the same, but you do need to start today.

The COVID-19 Emergency Budget Meeting

If there was ever any doubt about what an emergency might look like, well this is it, folks! I hope that each and every one of you is coping well and today I wanted to let you know what Jonny and I are doing, in the hope that you might gain a few pointers about what to do with whatever situation you may find yourselves in.

Emergency Fund: Poised for Action

For me an emergency fund is a lump of cash that sits in my bank account at the ready, poised for action, poised to save my butt from impending failure and doom, that can be readily accessed at a moments notice.