I first published this blog post back in June 2017. I’ve dusted it off and rewritten it today purely because of many conversations I’ve had over the last six months with people who have inherited large sums of money. Receiving money due to the death of someone you love is an awful way to come into money. So, if you are the recipient, make it count and make that person proud of the decisions you make with their money.

All tagged Net Worth

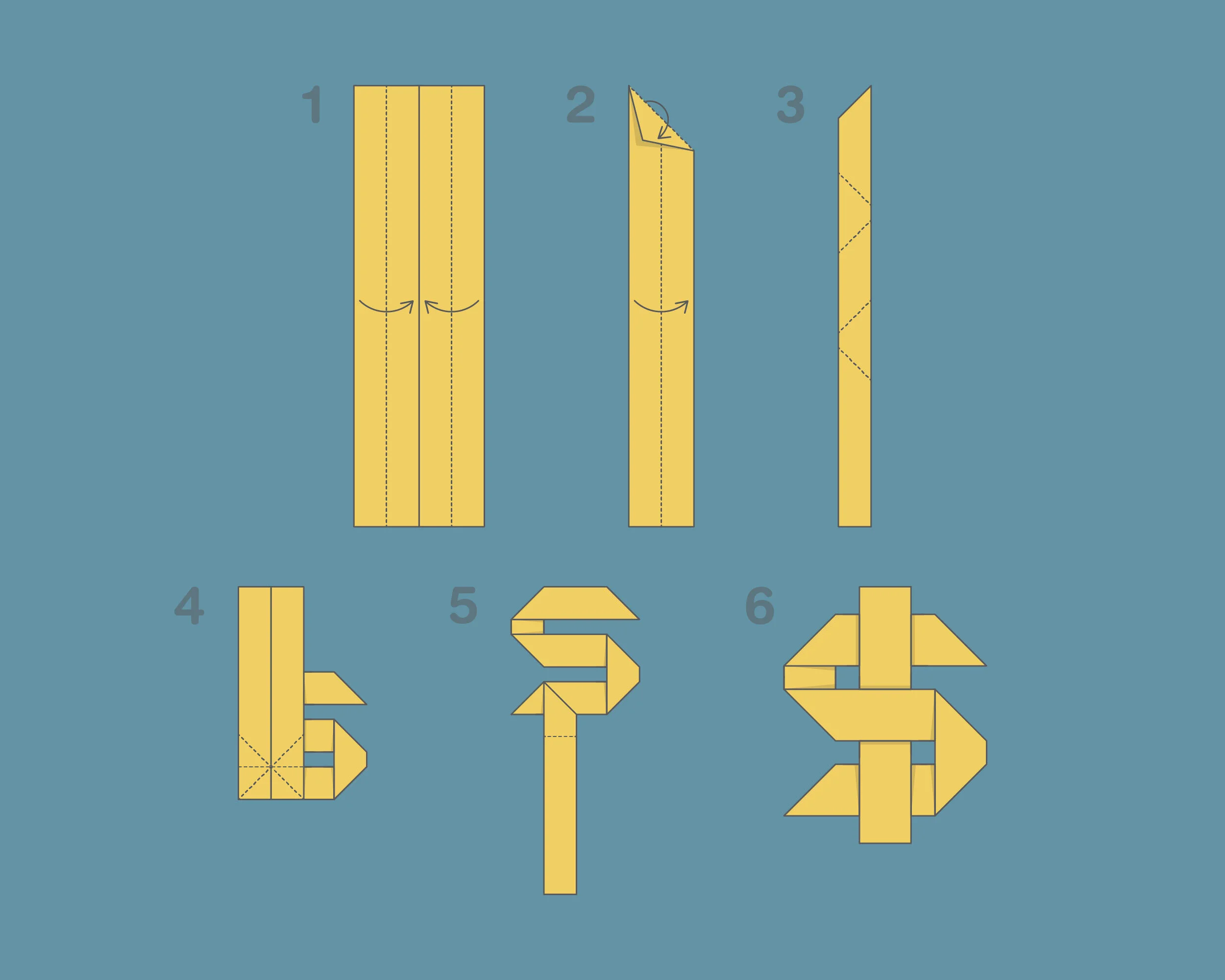

Begin at the Beginning: Step-by-step Path to Financial Independence

Whatever it is that you are embarking on that’s always the best place to start in my opinion. The beginning. Then just follow the path, in my case, the path to financial independence and eventually not being tied to a job to earn my income. It’s a long journey but it’s one worth starting. I’m often writing emails that cover the same points over and over again, so I thought that today I’d put that information into a blog post for all of the people wondering where to start and how to string all the bits of information you have learned about money into a cohesive order.

Finally, I'm a net worth millionaire!

I’ve waited a long time to fill out my own Net Worth Millionaire Questionnaire! YES, our net worth has finally ticked over from 6 numbers to 7 and it’s fair to say I’m delighted. But what is the purpose of me and other people sharing this information? It’s so that you can apply it to your own situation and see the variety of ways that other Kiwi’s have created wealth for themselves and know that it is possible for you as well.

End of year financial report…

This week I sat down and took a bit of an ‘end of year’ look at how 2018 has been financially for our household. I don’t do this on a set date each year, I just felt interested this week so I checked it out. Being the over-sharer that I am I thought you may also be interested?

How to rock a good spreadsheet...

Many people have requested a look at the spreadsheet that I use, so I have finally created one to share with you and from this you can go ahead and create your own.

The Happy Saver Top 10 Money Tips

Welcome to my shortest blog post ever! I have written a succinct list, using as few words as possible, that encapsulates the rules I live by in one way or another every single day.

Hairy Audacious Goal

Steadily and consistently increasing our net worth often has me concerned that I’m missing something, doing something wrong or doing it too slowly so it is time I set myself (and my family) a new short term goal.

Becoming an Investor*

All your working life you are trying to increase your net worth so that when you finally stop working you start to slowly spend it to live on. If upon retirement each year you take 4% out of your pot of savings it will take about 30 years to boil the pot dry. So what can you live on a year? Do you need to invest $100K, $200 or $500K?

Tracking Your Net Worth

It is important to track your net worth. How else can you know where you are financially so that you can plan for the future? The most important thing is to understand your financial position today so you can be moving in the right direction.